Imagine stepping into an enticing market in which every store is buzzing and bustling, or perhaps an office park that is high-rise, where a variety of innovative businesses coexist with multinational companies. This vibrant image demonstrates the enormous potential for commercial real estate in India. From small-scale Kirana markets to famous skyscrapers such as Mumbai's Bandra Kurla Complex, commercial property has grown to accommodate the various needs of businesses. As an investor or businessperson, we believe commercial property in India is full of opportunities.

Booming Sectors Driving Commercial Real Estate

The commercial real estate market in India is growing, driven by a variety of booming industries:

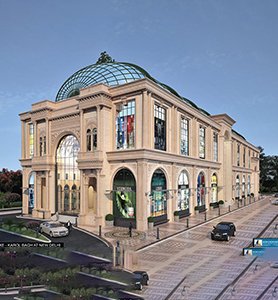

The Retail Revolution

Malls and shopping malls are thriving due to the expanding retail industry and the changing of consumers' habits. In addition, Tier 2 and 3 cities are also booming. Three cities are becoming the most lucrative locations for investment in retail.

Warehousing and logistics

With the rise of giants in e-commerce like Amazon and Flipkart logistic parks and warehouses have been booming sectors of commercial properties.

Co-working spaces

The rise of startup companies and the gig economy has increased the demand for co-working places in cities.

Key Cities for Commercial Property Investment

If you're interested in commercial real estate, a few cities stand out as potential investment attractions:

Mumbai

As the financial capital of India, Mumbai offers high returns on offices with premium facilities as well as retail stores.

Delhi NCR

Gurgaon and Noida thrive with the latest commercial projects, ranging from IT parks to luxury retail areas.

Bangalore

Known as the "Silicon Valley of India," Bangalore has a lucrative marketplace for office space, especially in the IT corridors.

Hyderabad

With business-friendly policies, Hyderabad is quickly emerging as a top option for commercial property investment.

Things to Consider Before Investing

Commercial property investment requires careful planning and consideration:

- Placement: Locations close to transportation hubs and business areas often provide better yields.

- Market Research: Understanding market trends and consumer demand helps in making informed decisions.

- Legal & Regulatory Compliance: Ensuring all documentation aligns with local regulations is crucial for a seamless process.

- Return on Investment Potential: Analyzing rental yields and appreciation rates helps in assessing long-term impact.

Commercial property in India is a reflection of the nation's aspirations for economic and business growth. Whether you're considering luxurious office spaces, vibrant retail hubs, or strategically located warehouses, India continues to attract both international and local investors, offering a plethora of possibilities.